Methods of Payment (to replace cheques)

Client resources

1. Online Banking

This is our preferred method of payment.

Please click on the link below to download how-to instructions for creating an internet banking tax payment with all major banks;

(if your bank is not included in the document – please contact them directly for instructions).

Internet Banking Instructions (with all major banks)

Please note – We recommend not using Debit/Credit cards for paying taxes due to the convenience fee that is payable at 1.42%.

If you are still unsure with doing an internet banking payment yourself, please contact us and we will set up a time to assist with some one-on-one training. If you have internet banking set up, please deal directly with your bank to set up.

2. Variable Direct Debit

Do your own

You can make your own variable direct debit payment through myIR. In order do to this, you will need myIR already, or get one set up.

To set one up;

Go to www.ird.govt.nz

(see Setting up your own myIR account instructions)

Making a payment with myIR;

Go to www.ird.govt.nz and login

(see Making a variable direct debit payment instructions)

3. Generating a Barcode from IRD and physically making payment at Westpac

This option requires you to create a barcode with IRD which you then present at Westpac (for them to make payment for you).

a) You can find a barcode printed on your Inland Revenue returns, statements or letters (as below)

b) Generate a barcode on the Inland Revenue website

To generate the barcode with IRD.

Please then print this barcode or have it ready to go on your mobile device, and take into a Westpac branch, where payment can be made over the counter with either cash or eftpos.

(Please note – The barcode includes all the details required for Westpac to make the payment on your behalf).

For assistance with generating a barcode with IRD online, please come to our reception and we can assist.

4. Other Options

- Go directly to your bank

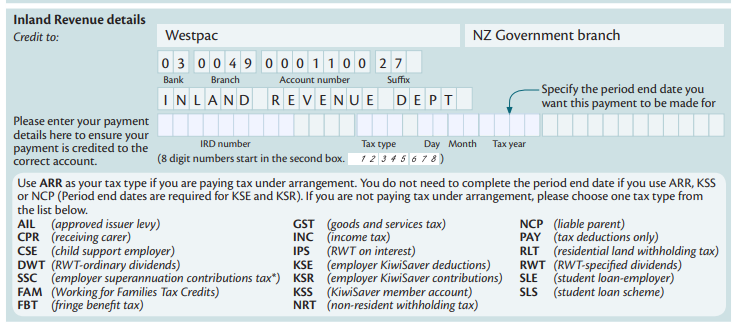

If you’d like to go make an over the counter payment with your own bank, please take the below IRD bank details with you (your bank will ask for these)

Please ensure you also have a barcode with you (see No.3 above).

Please note – Your bank may allow you to pay over the phone, please enquire with your bank.

- Phone BankingYou can pay your tax over the phone directly with IRD. Please visit the link below to find the correct phone number for your payment;

https://www.classic.ird.govt.nz/contact-us/contact-us-index.html?topic=phone_landing

- Cheque Exemptions

In some very rare situations, where none of the other options are available, IRD may give a cheque exemption.

5. Assistance with tax payments

If you require assistance to make tax payments, and none of the above options suit you, please call our office and we will arrange someone to assist you via our reception computer. (This requires you to come into one of our offices).

If you need support, assistance or further information, please fee free to call our offices at any time and our team can help you;

Morrinsville (07) 889 7153

Matamata (07) 888 8002

Thames (07) 868 9945

Each type of tax and IRD number requires a separate payment to IRD. You can no longer lump all your tax bills together and pay just one amount.

Please note – payment methods are subject to change based on IRD software systems release. We will make sure you are updated if these change.https://www.ird.govt.nz/barcode