Taxing Times: New Zealand's 2024 Tax Changes

As the calendar flips to 2024, New Zealand braces itself for a series of tax changes that promise to shape the fiscal landscape for individuals, businesses, and the economy as a whole. In our opinion the tax changes in New Zealand for 2024 are poised to have far-reaching implications in both their application and their outcomes.

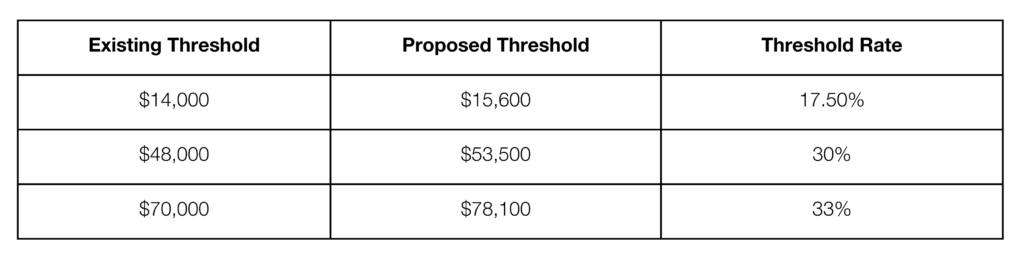

Income Tax Threshold Changes

The new government intends to change the tax rate thresholds from 1 July 2024. The proposed threshold adjustments are as follows:

In conjunction with the threshold change, the eligibility for the Independent Tax Earner Credit (IETC) is also said to expand to $70,000 (up from $48,000). IETC is the tax credit you’re eligible for if you earn between $24,000 and $48,000 per annum; you are not claiming Working for Families Tax Credits; your income is not an income-tested benefit; or you don’t receive New Zealand Superannuation.

Trust Tax Rate Increase

The last government introduced a Tax Bill on 23 May 2018 as part of their budget. Included in the Bill was a proposed increase in the Trust Tax rate to 39% (up from 33%). The Tax Bill expired and was not passed into effect prior to the election, the now Finance Minister Nicola Willis however confirmed on 12 February 2024 that the Trust Tax rate will in fact increase to 39% from 1 April 2024.

On 11 March 2024 there was an additional announcement by Nicola Willis in which she indicated that the Government is also proposing that trusts that earn less than $10,000 per annum (after deductible expenses) would still be taxed at 33%.

Inland Revenue released a high-level guidance document on 2 February 2024 on how it may view some taxpayer transactions and structural changes regarding the increase in the trustee tax rate. We will work with our clients where applicable to ensure that any changes to your tax planning or business structures are within the confines of the guidance provided by Inland Revenue.

Interest Deductibility and Bright-line test

The last Government took a hardline approach to property investors by changing the rules around the ability to deduct interest on the loans on rental properties, as well as changing the Bright-line test first to five (5) and then to ten (10) years (up from two).

Interest deductibility for rental properties will be restored on a phased-in approach over the next two years as follows:

- 80% deductible in the 2024/2025 income year

- 100% deductible from the 2025/2026 income year (full deductibility from 1 April 2025)

The Bright-line test for investment properties will be reduced to two (2) years (from ten (10) years) with retrospective effect from 1 July 2024 which in effect means that investment property acquired before July 2022 should no longer be subject to the Bright-line test at sale.

Speak with us if you are unsure if the Bright-line test will still apply to you or not.

Commercial Building Depreciation

Due to the impacts of COVID-19, the previous government announced in March 2020 a reintroduction of tax depreciation on commercial buildings for the 2020/2021 tax year, whilst it was originally removed in May 2010. The new government has indicated that it will remove the ability to claim commercial buildings depreciation, though we are uncertain when this will take effect, we expect it will take effect from 1 April 2024.

As individuals, businesses, and various stakeholders adapt to these evolving tax measures, understanding their implications is important for navigating the fiscal terrain of New Zealand in the year ahead.

Please do not hesitate to contact us if you would like to discuss any of the above and how it may affect you.

Written by Gerrie Jacobs.

Gerrie Jacobs

Partner, CA