The Minimum wage is increasing

Many of you would have heard and seen the announcement, that the minimum wage is set to increase 1st April 2023.

The Adult minimum wage will go up, from $21.20 to $22.70 per hour. The starting out, and training minimum wage will increase, from $16.96 to $18.16 per hour.

These rates are before tax and lawful deductions. It does not include 8% Holiday pay for casuals. This needs to be calculated on top.

If you have salaried employees, you must ensure that your team are not at risk of falling below the new minimum wage, should they work additional hours. You will need to revisit your calculation for the maximum number of hours each can work, per pay period, before requiring a top up payment.

The minimum wage is not the only change.

The ACC Earner Levy is increasing

In addition to the increase in minimum wage, the ACC Earner levy, which makes up part of your employees PAYE calculation, will also be increasing. This is a planned increase and is not in response to recent events.

The planned increase from 1st April 2023 is from 1.46% to 1.53%, or, $1.53 per $100.00 of earnings. This will impact of the amount of PAYE paid to the IRD, for each employee.

It is important that any salaried staff have their existing calculations revisited, to ensure the increase is accounted for.

Student loan repayment thresholds are increasing

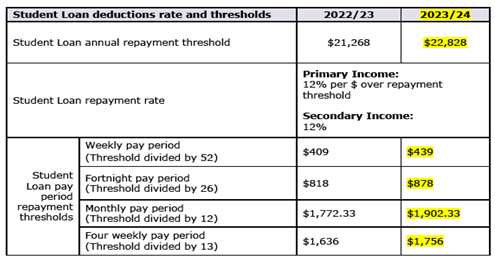

The amount of money an employee can earn before the 12% Student loan is deducted, will increase from $21,268 to $22,828.

On average, employees can expect to earn an additional $30 a week on their gross incomes, before the 12% Student loan deduction applies. Please see the table below for details.

How to prepare for the increases

1. Advise your team

If you have employees on the minimum wage, let them know about the increase they will be getting. You should send them a letter or email (variation of employment contract) advising them of the new wage.

2. Check your payroll systems and processes

Talk to whoever runs your payroll system: your payroll provider, accountant, lawyer, and HR or finance people to make sure they are ready to implement the change.

If your system is manual or computer-based you should check and confirm the settings will be adjusted for the new rates.

If any of your employees are on starting-out or training wages, now is a good time to check when they will be eligible to move onto the adult rate.

3. Employee pay relativity

You may also wish to consider potential impacts on your business due to internal wage relativity (for example, how employees are paid compared to each other) and external benchmarking (such as how your pay rates compare to others in your industry or sector). Employees on higher wages may possibly want to negotiate a pay increase to keep the relative difference.

Cooper Aitken Payroll Division understand that change can be stressful, and updating wage and salary calculations may not sit high on the list of priorities for 1st April 2023. Our services are not limited to existing payroll clients. We can also assist clients that process wages in-house, by preparing a comprehensive wage and salary calculation that clearly outlines the changes for your staff, and you can proceed with updating your employee records with confidence.

Give our friendly team a call on (07) 889 7153, or send us an email at wages@cooperaitken.co.nz