Important acc levy changes

ACC have announced some changes in the new levy year which include some adjustments that may possibly affect you.

Working Safer Levy

From 1 April 2025, Working Safer levies for all CoverPlus Extra policyholders will be calculated based on the level of cover rather than liable earnings which has been the case in the past.

What is a Working Safer Levy? ACC collect this levy on behalf of WorkSafe New Zealand. It goes towards supporting WorkSafe’s activities and injury prevention across the country.

This change means the following will now occur:

- Eventually, if you hold a CoverPlus Extra policy your Working Safer Levy will be included in your annual invoice at renewal time. This should start occurring in April 2026.

- The transition period means you may be receiving your 2025 Working Safer Levy based on your liable earnings as well as your 2026 Working Safer Levy which is based on your level of cover this year. You may already have received your 2026 levy and your 2025 levy will be generated after your 2025 tax return is completed.

- If you are a Shareholder-Employee and are on CoverPlus Extra you won’t get a Working Safer Levy invoice under your company policy anymore. If you have been on CoverPlus Extra for part of the year, the pro-rated business invoice will still apply.

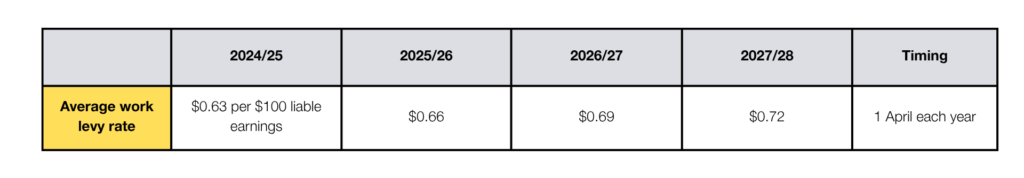

General Levy Increase

Every business and self-employed person in New Zealand pay a work levy which goes into an ACC Work Account. There is to be a small increase every year over three years from 1 April of each year.

Classification units for sports and home improvement businesses

There have been some changes regarding ACC levy classification units to better reflect the business activity your engaged in and the risk associated with that particular activity. There may be increases or decreases to levies depending on certain criteria. Please click here for an informative breakdown.

No Claim Discounts

- No Claim Discounts have always been applied to ACC policies as a loading or discount based on the claims history

- The No Claims Discount adjustments will no longer apply for the 2027 levy year onwards. From this date your Work levy will be calculated using a rate determined by your business activity (Classification Unit) only. ACC feel that this scheme isn’t delivering improved health and safety outcomes as first expected so change is required.

Payment Plans incurring interest

Currently all ACC levy payers using a direct debit payment plan of either 3 or 6 months do not pay interest. From 1 April 2026, interest will be applied to all plans.

The reason ACC are using this method is to improve fairness across the board and better encourage on-time payments.

You will be given the option to opt out of your payment plan closer to the time.

Penalty interest rates will also be updated to align with new interest formulas.

Got a question? Let our ACC Team assist you.

07 889 7153 or acc.morrinsville@cooperaitken.co.nz