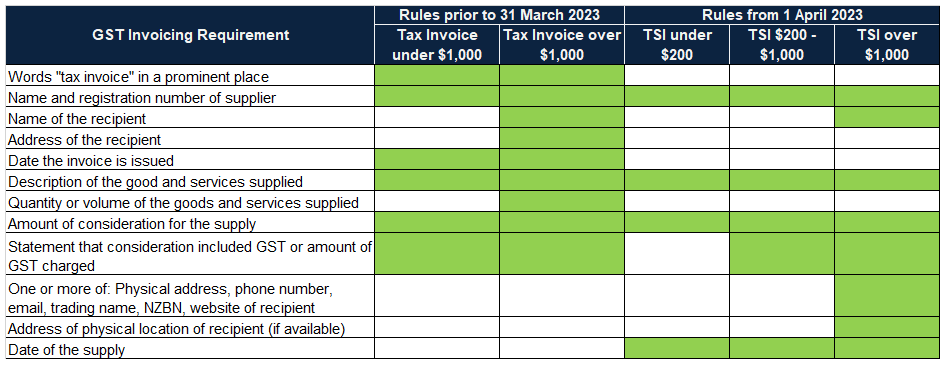

In March 2022, the government announced changes to the GST invoicing and record-keeping requirements, however, this was not enacted until 1 April 2023.

These new rules have been introduced to allow for more flexibility around GST invoicing and record-keeping. GST rules have been largely unchanged since the inception of GST in 1986, which does not align with today’s business world as there have been significant changes to technology and the way business is conducted.

The requirement to hold the “tax invoice” in order to be able to claim GST on that item has been replaced with holding business records instead, and the responsibility now falls both on suppliers and customers.

Under the new rules, you can continue to issue your tax invoices and GST credit notes without making too many changes to your systems.

The low-value threshold is lifting from $50 to $200, meaning that taxable supply information is required for any supplies over $200 rather than $50.

There is no longer a requirement for approval from Inland Revenue for the issue of Buyer-created tax invoices (buyer-created taxable supply information). This has been replaced with an agreement in writing between the parties to evidence the use of self-billing.

It is important to understand the terminology changes:

- “Tax invoices” are now referred to as “Taxable Supply Information (TSI)”

- “Debit Notes” and “Credit Notes” become “Supply Correct Information (SCI)”

- “Buyer Created Invoices” become “Buyer Created Taxable Supply Information”

- “Supply Information” is the list of information required on certain situations when the supply is not subject to GST

Even though you may not be required to make any changes, it is still important to know about them as your suppliers’ invoicing practices may be changing and this could impact the way you conduct your business.

Some things to be aware of are:

- You can continue to issue “tax invoices”, “debit notes” and “credit notes” if you wish. Check that your templates include the correct GST information. You do not need to provide the TSI if the customer is not registered for GST or the amount charged is under $200 (incl GST).

- TSI must be provided to GST registered buyers within 28 days of a request for supplies over $200. You must keep this information on file.

- Instead of issuing any of the above documents, you can provide a list of information (TSI) in a format chosen by you – in an email, electronic invoice, or an exchange of data with your customer or supplier via an e-invoicing system.

- You are not required to use or include the words “taxable supply information” in any document you provide as part of the TSI.

- You don’t need to issue a SCI of the error in the TSI if it has no GST impact.

- You can claim GST on a payment you make to your supplier and the TSI is required from your supplier in their selected format instead of a “tax invoice”.

- The TSI does not need to be received in the one document or format. It can be received in multiple formats and is up to the supplier on how this is done.

Are your systems capable?

With these changes, it can have a large effect your business systems and it is a good opportunity for you to review your system’s capabilities to ensure you can send/receive and hold TSI. Here are some questions to ask yourself:

- Do you need a supporting system alongside your accounting system such as invoice scanning software? This software generally checks the parameters to accept/reject invoices – for example, looking for the words “tax invoice”

- Do you need to consider your system’s abilities in relation to employee reimbursements, credit card reconciliations and the wider finance system to process TSI and the increases to the low-value threshold

- Do you have a customer and supplier database that is able to hold key information such as IRD numbers and addresses?

- Are your systems ready to move forward towards potential e-invoicing?

- How can you capture the approval from other parties to issue buyer-created taxable supply information?

- Are your finance staff educated on the new taxable supply requirements?

- Do your internal policies and procedures need to be reviewed in this area?

- Are your general terms of trade aligned with these changes?

See below a chart that shows the changes in rules from 1 April 2023.

Paperless Systems:

With the above changes in effect, it is a good opportunity to consider converting to a paperless system. This can increase the efficiency of your organization as well as create some time and mind freedom within your business. Although it can be unrealistic to eliminate every sheet of paper from your office, we can help you take the right steps toward this. You will need to ensure you have a good-quality scanner and an online filing system (such as Hubdoc) available for storage.

Advantages of a paperless system:

- Storage – up to 25% of your firm’s office space could be used for the storage of paper documents. This is a big overhead, which may be holding you back from other things like taking on more employees.

- Time freedom and increase in productivity – It can be hard and very time consuming to find the right piece of paper amongst a pile with thousands of others. An online filing system with a powerful search function will reduce the time spent looking for documents and increase staff productivity.

- Waste – There may be duplicate copies of these documents and they may be filed in different places for different reasons. Going paperless will reduce this duplication and essentially reduce the waste as well – the paperless system is environmentally friendly.

- Appearance – Your office will be more aesthetically pleasing with less clutter as there will not be piles of paper and files throughout your office. The office will appear more like a professional working environment and will be more inviting to visitors, employees and clients.

- Mind freedom and more focus – Without a desk covered in paper, employees with be able to think in a more clear and logical way.

- Printing Expenses – Without printing as much, the costs of paper, ink, printers and other associated expenses will reduce. This can be significant, even for a small firm.

When you have made the decision to go paperless, find a plan that works for you. Every firm is different with its requirements, but some pointers for making that big step:

- Set a date and make this clear to all the team within the business. Diarise this in all calendars so everyone knows.

- Use the cloud – Do not store the scanned documents on a hard drive or USB stick – keep them safe by using online storage.

- Set up a filing structure – Do not dump all files into the same folder, instead set up a folder for each client or each year.

- Scan what you need – You do not need to scan everything. Instead, only scan what you need. For example, if your files go back 20 years for some clients, you won’t need to scan in all of these documents. Start with only what you need and then fill in the gaps as you go.

- Avoid duplication where possible – There is no need to scan in the same document twice

- Allow for a productivity dip – While this conversion is happening, there is more than likely going to be a drop in productivity in your firm. Arrange for this to happen in a quieter work period. If you can, hire some temporary staff to help you manage with the extra work load.

- Train your employees to use the new system – The more training you provide to your people, the more you will get out of your new system. It will be much easier for them to find the information that they need.

Once you have eliminated most of the paper from our office, it won’t be long until more paper arrives, so make sure you keep on top of it! Set aside one day a week, or even one afternoon a week to scan and file the new documents. If you need it to be more frequent, make it a part of someone’s daily routine in the office. Encourage all of your clients, suppliers and other business associates to send you their documents electronically rather than physical paper copies.

Our software team are experts in this area and have held webinars on this topic, so if you are wanting to take the steps to create more time and freedom within your business to go paperless, please get in touch with us.